What is striking off a company? – A Definition

According to the Collins English Dictionary the term “Striking Off” means:

to remove or erase from (a list, record, etc) by or as if by a stroke of the pen

How to strike off a company

Read this next section to learn the steps involved in how to strike off a company.Reasons a company can apply to be voluntarily struck off the register

Before a company can be struck off the Registrar will need valid reasons. There are many reasons that a company could be struck off the register, these include:

- Director conflict – in some cases there may be disagreements and conflict between Directors, in which case a sensible option could be to dissolve the company

- Dormant – the company may not any longer trade

- Low profitability – a company may simply have low profitability (or maybe even trade at a loss) and therefore Directors feel it should be closed

- New challenges – Directors may see new challenges opening up to them and close a company to focus their thoughts elsewhere

- Retirement – all Directors wish to retire and therefore there is nobody to operate the company

- Subsidiary closure – the company may be a subsidiary, which needs to be dissolved, perhaps as a part of company restructuring

Reasons a company may not apply to be struck off the register

A voluntary request for striking off a company can be made when a majority of Directors wish to do so. The Companies Act 2006 in sections 1004 and 1005 provides reasons where a company cannot apply to be voluntarily struck off:- Where in the past 3 months the company has:

- Actively traded – this doesn’t include meeting statutory obligations and tasks associated with preparation for company closure (e.g. seeking professional advice and paying debts)

- Changed name

- Active insolvency proceedings – if a company has insolvency proceedings against it (e.g. liquidation). This includes early stages of insolvency such as where a petition for insolvency has been presented

- Active scheme of arrangement – a company may have a scheme of arrangement in place, i.e. an agreement between creditors and itself to restructure debt. This is as detailed in The Companies Act 2006, sections 895 to 901

- Bearer shares in issue – where a company has bearer shares a voluntary strike off can’t be requested. Bearer shares are where a shareholder is not anonymous and therefore isn’t named on the register of shareholders

Note: The max amount of assets that can be distributed as capital is capped at £25,000, including share capital. If assets are higher then a Members Voluntary Liquidation (MVL) should be considered; allowing distributions to be treated as capital fully rather than dividend income.

When applying for voluntary strike off, it is always advisable to seek professional advice first. Contact us today: 0121 201 1720. We can advise with no obligation on all the legal aspects (e.g. changes in relation to dissolution and unpaid BBLS / CBILS) and rationale of applying for striking off a company.

Actions to take before applying for a company to be struck off

Once you have determined that there are valid reasons to dissolve a company, there are some everyday practicalities and actions to take before applying. We have provided a list here of tasks to consider. Note: this isn’t an exhaustive list and won’t cover every eventuality, but will give an idea of some of the most usual tasks to undertake:

- Close bank account – funds in the company bank account should be withdrawn and shared amongst shareholders. The bank account should be closed

- Government agencies – relevant government agencies to the company business should be notified

- Inform interested parties – all parties affected by the strike off should be informed, this includes creditors, employees, members, etc.

- Local authority – the prevailing local authorities should be notified for Council Tax reasons and also where the company activity impacts areas such as planning and health

- Sell assets – any company assets should be sold and dispersed amongst shareholders, as after dissolution these assets will pass to the Crown

- Tax – the HMRC should be notified so that tax affairs can be smoothly concluded

There needs to be at least one active company Director to apply for voluntary striking off. Therefore, it is not always wise to resign prior to application.

Applying for strike off

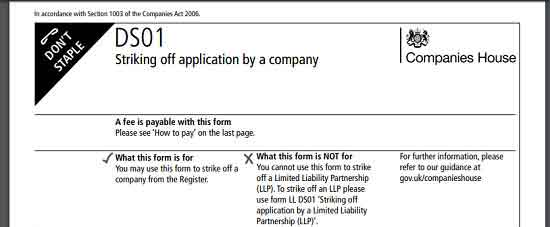

The form DS01 - Striking off application by a company will need to be completed by either:

- Sole Director – where there is only one Director

- Both Directors – in cases where there are two Directors or

- Majority of Directors – where are there are three or more Directors

The form needs to be completed and sent off to the relevant Companies House in Belfast, Cardiff, Edinburgh or London.

Within seven days of applying for strike off the Directors must send a copy to interested parties, which include:

- Creditors – any party, which is owed money by the company

- Directors – all Directors who did not sign the form

- Employees – all employees of the company

- Members – most frequently Shareholders

- Pension fund – a copy must be sent to the Pension Fund Trustees or Management

Any new members of the above groups arising need to be notified, e.g. a new employee.

What will Companies House do upon receipt of the application?

Upon receipt of the application the applicable Companies House will adopt the following process:

- Accuracy check – there will be a check for accuracy and that the form is signed by all required parties

- Acknowledgement – once 1) is completed, Companies House will send an acknowledgement to the address given on the form

- Notify at the registered office – a copy of the notification will be sent to the registered office of the company, just in case there has been a bogus application

- Publish a notice in the Gazette – a copy of the notification will be published in the applicable Gazette (London (for English/Welsh companies), Belfast (for Northern Irish companies) or Edinburgh (for Scottish companies) version) for a minimum period of two months. See: https://www.thegazette.co.uk/ for further details

- Add Gazette notice to public record – add a copy of the Gazette notice to the companies’ public record

- Strike company off the register – if after a minimum period of two months there has been no objection then the company will be struck off the register

Compulsory Strike Off

In the previous section, we talked about voluntary strike off, where it is decided that there is no longer a need or use for a Company, so it is voluntarily struck off the register. The process though can also be compulsory, i.e. through the petitioning of a third party.

Reasons for a compulsory strike off

Most usually compulsory strike off is through Companies House, who will strike a Company off the register for reasons such as:

- Required Company documentation has not been sent (e.g. accounts or annual statements)

- Mail sent to the official registered office of the Company is returned undelivered

- The Company no longer has any Directors (perhaps following a resignation or death)

The process to strike a company off the register

- The Registrar will send 2 formal letters to the Company asking whether it is still trading and in active operation

- If following (1) the Registrar is satisfied that the Company is no longer active, then:

- an advertisement will be placed at The Gazette (Official Public Record). This advert will state the Company will be struck off the register unless reasons not to do this are provided

- An entry will also be added on the company’s public record of the intent to dissolve.

- If following (2) no reasons for the Company to continue are provided another notice will be added to the Gazette stating that the Company has been struck off (or dissolved).

Effects of Dissolution

It is also worth noting and considering:- from the date of dissolution company bank accounts will be frozen

- assets and any bank balance will pass to the crown and a company restoration will be required to get them back

- where a company has been dissolved and not liquidated, a directors claim for redundancy and other entitlements will be lost

- a liquidation will usually mean that creditors do not look to restore the company, to pursue claims

Will dissolution end all debts?

If an insolvent company is dissolved without first being liquidated, it is open to creditors to apply to restore the company to the register and then pursue a debt or get their choice of liquidator appointed. So avoiding a liquidation, will not necessarily deal with creditors once and for all.

How Greenfield Recovery can help

Dissolving a company can be a challenging, complicated, emotional and frustrating process.

Why not call today on 0121 201 1720 to discuss your situation regarding how to strike off a company? Our professional legal staff can investigate your circumstances and discuss the best options for striking off a company, which are open to you. If you are interested in booking an appointment, then click this link.

We can provide guidance in all related areas including:

- How to avoid your Company being struck off (within the window)

- What to do if your Company has already been struck off

- Recovery of assets – “bona vacantia” (vacant goods) of a dissolved Company

- Restoring a dissolved Company to continue to trade

- As well as numerous other areas of advice too

- We also advise visitors to read our FAQ pages and also our blog posts